On November 13th, the IRS released a number of inflation adjustments for 2026, including to certain limits for qualified retirement plans. The table below provides an overview of the key adjustments for qualified retirement plans.

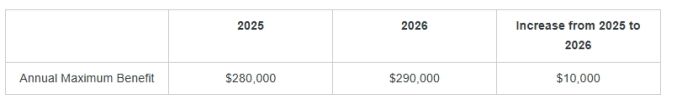

Qualified Defined Benefit Plans

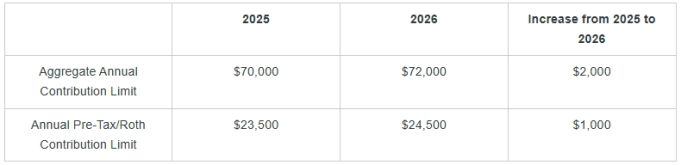

Qualified Defined Contribution Plans

Qualified Defined Contribution Plans – Catch Up Contributions

Other Adjustments for Qualified Plans

*If a participant’s FICA wages earned during the prior taxable year are above this amount, then the participant may only make catch-up contributions on a Roth basis in the following year. For example, a participant who earned more than $150,000 in FICA wages in 2025 may only make Roth catch-up contributions in 2026.